Plastics Largest Sector in Euro Food Packaging in Value Terms

Innovation continues to drive the industry, according to the new European Food Packaging 2000, with recent advances including new polyethylene and polypropylene types, which due to the development of polymerization catalysts, provide enhanced material properties.

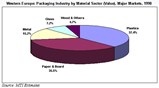

Plastics packaging is now the largest sector of the Western European packaging industry in value terms, accounting for a 37.4% share in 1998, ahead of paper and board (35.5%). Metal is the third largest sector in value terms. In volume terms, paper and board (36.1%) and glass (24.9%) are the largest packaging sectors, respectively, in 1998. Plastics volume share is put at 16.9%.

The performance of the European packaging industry as a whole in 1998 was relatively solid following the weak years of 1996 and 1997, which were essentially periods of reorganization for many of Europe's large packaging companies in the face of an increasingly competitive operating environment. Although Western European markets have been fairly resilient to global economic shocks in recent years, the effects of the Asian turmoil and the Russian crisis of 1998 are likely to continue to dampen growth in packaging output across Western Europe as the export market remains volatile.

Italy Coming on Strong

Of all the major markets, Italy has seen the greatest growth in packaging output and is rapidly catching France as Europe's largest packaging producer. Germany accounted for the largest share of the overall Western European packaging industry in 1998, at 23.7%, worth EUR21.48 billion. The four major markets, including the U.K., account for 74.3% of the total regional market. However, while the packaging industry in the large markets such as Germany and France is maturing, smaller producers such as Spain, Denmark and Finland are showing strong progress.

Plastics have fared notably better than the other sectors during the 1990s to date. Growth in plastics packaging was particularly strong in 1994 and 1995 and is now achieving consistent high growth. The European plastics packaging market was equal to 12.3 million tons in 1998. The largest market is Germany, with total consumption of 2.5 million tons, followed by Italy, France and the U.K. Overall, more than half of all plastics packaging is used to package food.

In milk packaging, for example, plastic bottles and pouches now command 34% of the Western European market, behind the 56% share held by cartons, but growing strongly. Lightweight, blow-molded high-density polyethylene (HDPE) containers (polybottles) are proving to be more popular than liquid cartons in some markets. Growth is mainly due to the current consumer trend of buying larger sizes. To increase their economic viability, polybottles are beginning to be filled at the dairy, similar to cartons.

PET a Major Player

The latest introduction, however, has been the polyethylene terephthalate (PET) bottle for milk. Schmalbach-Lubeca and Campina Melkunie have developed a PET bottle for fresh milk that is being used by Parmalat in the Belgian, Dutch and Italian markets. Over the next five years, Schmalbach-Lubeca is expecting to sell 350 million PET bottles for dairy products in Western Europe. Italian dairy Granarolo is also selling pasteurized milk in one-liter PET bottles, produced from Tetra Pak preforms.

The PET bottle in general has been a major growth format and is now the dominant packaging type for carbonated soft drinks, accounting for about 57% of volume. Future high growth markets for PET containers are likely to involve hot-fill and large serving-size bottles in sectors including beer, food, milk and beauty products. In particular, products that are already converting from glass to PET, such as sauces and condiments and edible oils, represent good prospects.

Plastic Packaging Attractive Sector

Most of Europe's largest packaging companies are involved in plastics packaging. The sector remains relatively unconsolidated, due to the scope of end-user markets covered, but highly attractive and usually the scene for significant corporate reshuffling. The major European rigid plastics packaging companies are headed by Schmalbach-Lubeca, the RPC Group and Crown Cork & Seal. In films and flexibles, Lawson Mardon, Cryovac and Danisco lead.

In July 1999, meanwhile, Huhtamaki acquired Van Leer, creating one of the largest European plastics packaging companies. However, a three-way merger in aluminum and packaging between algroup, Pechiney and Alcan (A.P.A.) announced in 1999 would also create a global leader in flexible and specialty packaging.

The outlook for the plastics packaging industry is very positive, and within the food packaging industry it is certainly the material that offers most growth potential. In particular, rigid plastics are expected to do well in response to demand for PET and the increased penetration this format will have in Southern Europe. New materials such as polyethylene naphthalate (PEN) are also expected to widen the markets open to rigid plastics.

Available from Market Tracking International for £975 (US$1,650), European Food Packaging 2000 analyzes the latest developments, performance and prospects in the European food packaging industry and its most dynamic end-use food markets. The report includes analysis of key, high-growth food packaging sectors, including fresh and chilled foods, dairy products, frozen foods, preserved produce, ready meals, snacks, confectionery and soft drinks. The report also includes packaging material sector studies on paper and board packaging, rigid and semi-rigid plastics packaging, films and flexible packaging, metal packaging and glass packaging, as well as individual national packaging market studies on the 12 key European countries.

For more information on MTI's report: Chris Brockman, Tel: (00 44) 171 263 1365, Fax: (00 44) 171 272 8525, Email: c.brockman@marketfile.co.uk.

Edited by Bill Noone, Managing Editor of Packaging Network